A Grand Opportunity

In 2017, congress passed the Tax Cuts and Jobs Act. This created the first new community development tax incentive in decades: Opportunity Zones. The governors of each state were tasked with selecting land tract zones where the Opportunity Zone tax incentive will apply.

In short, the tax incentive allows you to allocate capital gains within 180 of being received. This gain must remain in a Qualified Opportunity Zone Fund for a specified amount of time. Those funds can then be utilized for real estate development and business investment within the zones.

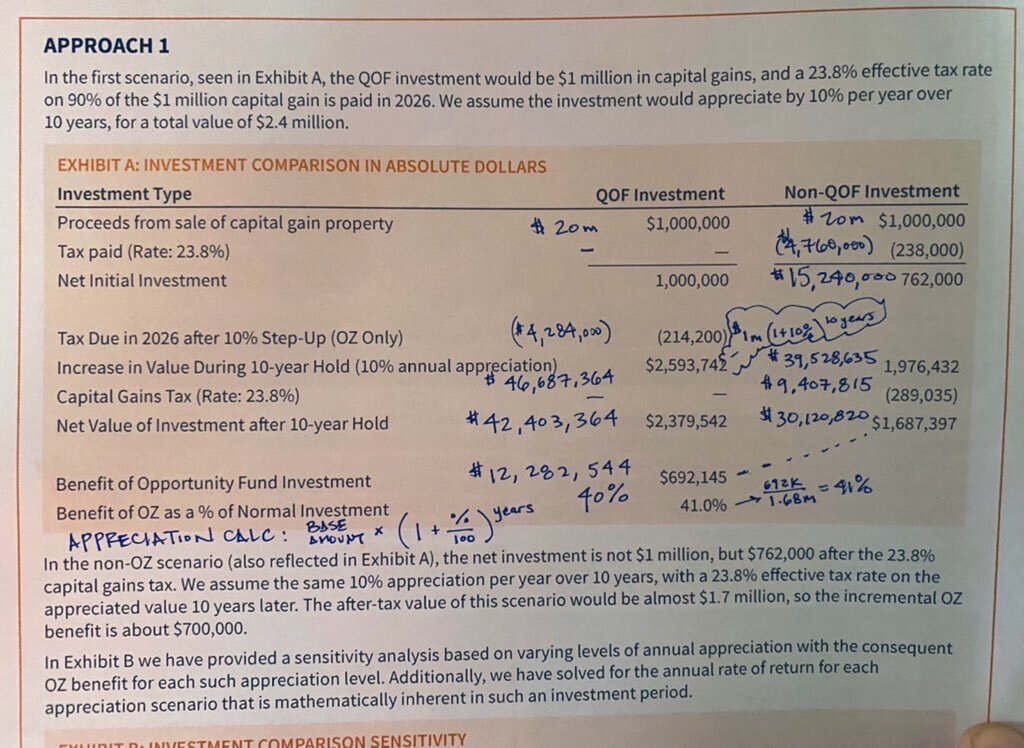

The allocated capital gains in the fund is rewarded with a initial tax deferral until the end of 2026. The capital gains retained in the fund receive a 10% capital gains tax reduction after 5 years, a 15% reduction after 7 years, and the complete exemption of capital gains tax if retained for 10 years. In addition, any appreciation on the value is excluded from the capital gains tax. It is important to note that the capital gains will still be taxed after 2026 but the principal is taxed at the reduced rates.

Regardless, the amount of tax savings if the capital gains are retained in the fund for 10 years is significant. It is also critical to note that this capital gains tax incentive is applied for federal taxes. The states also have capital gains taxes and most states comply with the Opportunity Zone incentive.

Unfortunately, California, and a couple of other states, still require state Capital Gains taxes. Thus, the benefit of the Opportunity Zones incentive is severely stunted. The final months of 2020 saw many major companies leave California for more tax friendly states partially because of the states inability to sustain and adjust. Hopefully, California begins to reverse this trend and provide the benefits to retain corporations and commerce and spark new development from areas other than the public sector which creates heavy cost burdens in other areas.